How I Made £119 Profit Trading Tennis [GUEST POST]

This is a guest post from Dan O who is a member of both Ultimate Football Trading and Ultimate Tennis Trading.

Take it away Dan!

As promised yesterday, I am ready to share with you a trade that brought me over 93% ROI in a set of tennis.

I’m really proud of this considering the price on the favourite only varied a total of 14 ticks, between 1.04 and 1.18. Moreover, my matched orders were in an even smaller range, between 1.05 and 1.14.

Read on if you think that’s interesting!

Spotting the Opportunity

This Tuesday was a fairly quiet day in terms of sporting events and, while looking for opportunities, I spotted what I thought was way too short a price on Rybakina to win her Miami quarter final against Trevisan.

I remembered lurking on Betfair’s in-play list during Trevisan’s last match, against Ostapenko, and noticing that even when she was 2 breaks up in the first set, she was trading above evens.

She did give away one break, but eventually won the match in straight sets, which made me think she was a seriously undervalued player.

I checked for recent form on Flashscores and indeed, Rybakina was at 90 or even 100%, whereas Trevisan was only at 50%. However, all those 5 wins had happened in the previous 6 matches and I also read the summary, to find out that Rybakina had 2 defeats in 2023, both of them against left handed opponents.

Trevisan is a leftie herself.

Placing the Initial Lay Orders

The match was scheduled at 7PM and I spotted it before noon, when Rybakina was available to back at 1.08 and to lay at 1.09. I placed an order to lay her for £200 at 1.08.

I checked a while later and my order was taken, which now created a gap: lay price stayed at 1.09, but you could back at 1.07. There were already over £40,000 on the market, but I placed another lay order of £200 at 1.07 myself, as there were still many hours left until the match would start.

The order didn’t get matched and the price went the other way. When it reached 1.1 to lay, I thought I remembered the cash cow.

I layed £200 at 1.1 pre-match and also placed a back order at 1.2 and another £400 lay at lower odds.

Exploiting Support and Resistance Points

I kept checking the odds throughout the afternoon and the Betfair graph said Rybakina had been matched between 1.07 and 1.14.

These sounded like plausible support and resistance points for the first set, especially as while they were warming up, the price stayed in the middle of the range: 1.1 to back and 1.11 to lay. I considered what’s the maximum I was willing to risk on the trade and settled on £150.

At this point, I had my 2 £200 lay orders matched at 1.08 and 1.1, but also the unmatched £400 lay at 1.05 and £200 at 1.07. So my matched liability was £36 and I wanted to keep the unmatched orders, for the sake of being up high in the queue.

But I also wanted to exploit those support and resistance points I was expecting, So I ordered an extra £1100 worth of lay at 1.07, to take my maximum liability when all would be matched £147.

Multiple Successful Swing Trades

I got everything matched at 1.07 during the first game, as Rybakina started in quite a dominant fashion. So I was £127 in and decided to cancel that order at 1.05.

It was moot at that time anyway, as she only dropped to 1.06. Trevisan struggled a bit, but held her serve to 30 and then she somehow managed to get 2 break points on Rybakina’s serve.

I had ordered £1300 at 1.14 as soon as I got matched at 1.07, so it was only the third game and I already knew I could no longer lose anything on the trade. I had about £55 profit on Rybakina and £400 on Trevisan at this point.

Rybakina somehow managed to hold serve, so I went for another lay of £500 at 1.07. When she was about to break the next game, I also placed another lay order of £200 at 1.05.

I could’ve sacrificed all green on Rybakina, but for my sanity, I wanted to know there’s still £10 left on her if she runs away with the match and my connection drops and I can’t cash out for more.

So at this point I had £10 on the favourite and over £1000 on Trevisan, but it wasn’t looking great, as the score went 4-1 to Rybakina.

But then Trevisan won the next 2 games. It was beautiful when she converted the break point: she slid and fell before returning a ball and it looked like it was going to stop in the net, but it just bounced over inches into Rybakina’s side.

I also love that tennis players raise their hand to apologise when they get lucky shots like this.

So now my back orders at 1.1 and 1.14 were matched, to reduce the gap in profits and leave me with ?100 on Rybakina and £400 on Trevisan. Trevisan was about to serve at 3-4 and Rybakina was now being matched at 1.18.

Securing Final Profit

I figured I only needed Trevisan to go one point up on her serve to have my very old back order of £200 at 1.2 matched, which would then level up profits even nicer: £140 on the favourite and £200 on the underdog.

That would’ve completed all my cash cow style trades and I would’ve aimed to cash out as close to £200 as possible if Trevisan went a break up or in any case, at the end of the set.

It wasn’t meant to be quite this good, as Trevisan never led during the next game.

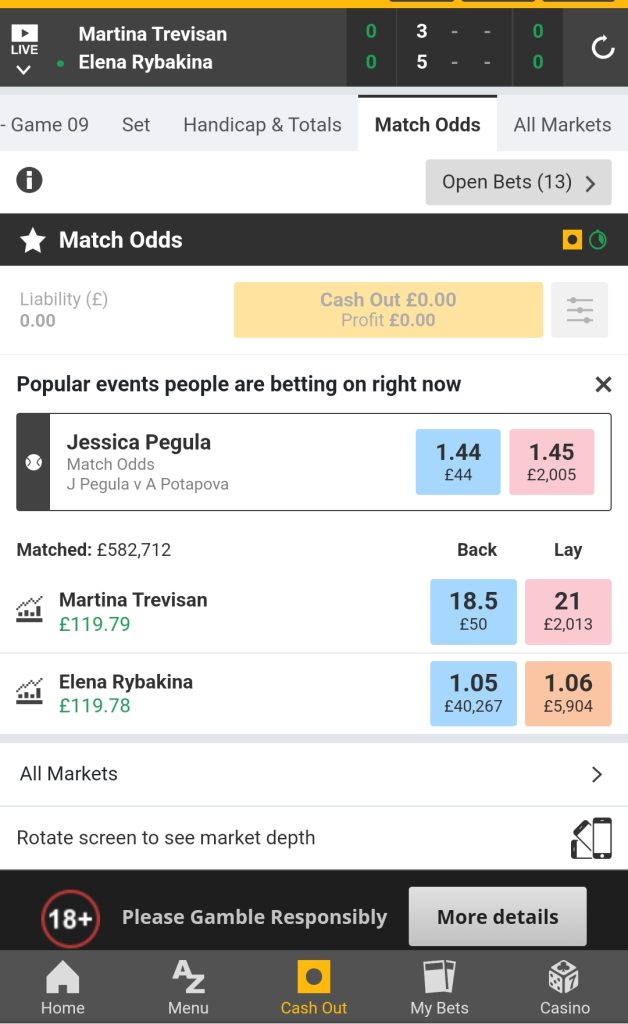

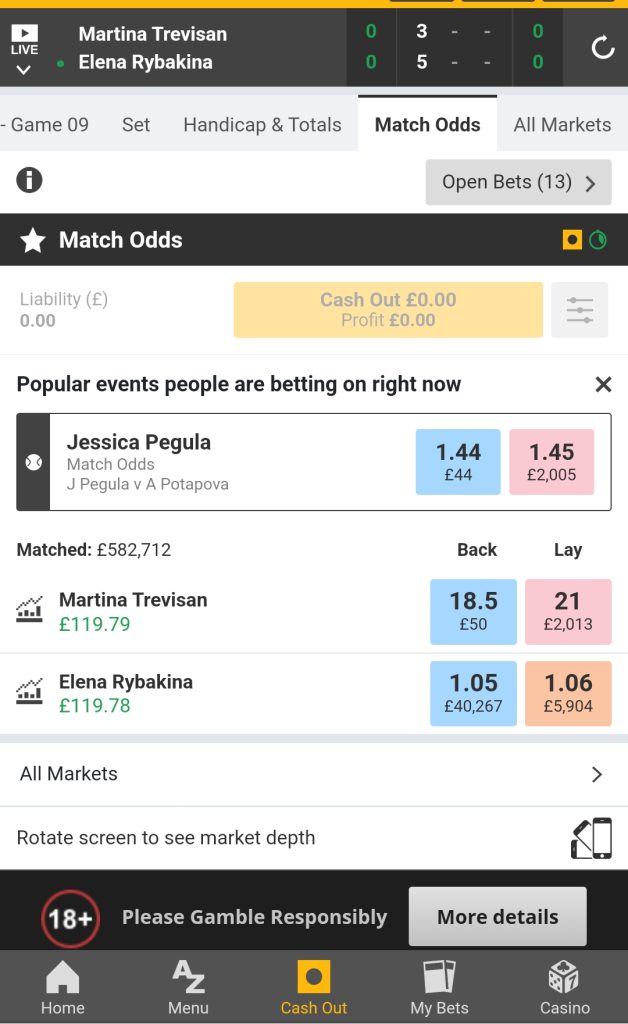

As the score found its way to 15-40, I was working out the maths. The maximum cash out value available at Rybakina’s highest price of 1.18 was around £130, but by the time she got those break points, my winnings were slightly lower (see the screenshot).

I figured this was the right time to exit, as Trevisan had lost 3 consecutive games when she failed to convert her early break points, so it was bound to be even worse now that she was about to concede serve right after her break. And I was right, from that point onward, Trevisan never won another game, and Rybakina run away with it: 6-3, 6-0.

In summary, I started with a money method trade by laying Rybakina at 1.08, which taken individually, would’ve

been a losing trade, as Trevisan never went a break up.

But I had 3 successful cash cow style swings, with £1300 and then £500 at 1.07-1.14, and the £200 at 1.05-1.1, so I am really happy with the outcome: £127 maximum risk in the market and just shy of £120 final profit, secured by the end of the 8th game.

Conclusion

In conclusion, this trade demonstrates the importance of identifying market inefficiencies and exploiting them to your advantage.

By spotting a price that was too short on Rybakina and taking advantage of support and resistance points in the market, I was able to make successful trades and secure a significant profit.

While not every trade will be as successful as this one, by carefully analyzing the market and taking calculated risks, it’s possible to make profitable trades in tennis like this.

-----------------------------------------------------------------------

Want to see HOW we make Correct Score Trading Profits Like This?

Check out our FREE Correct Score Trading ebook while it is still availableand get it all explained.

Price: FREE

Just tell us where to email it to...

CLICK HERE TO DOWNLOAD NOW!-----------------------------------------------------------------------