Betfair Golf Trading Strategies: The Ultimate Guide To Trading Golf On The Betfair Exchange

In this article, we will be giving you a beginners guide to trading golf on the Betfair Exchange. Be sure to bookmark this for later use 😉

As an experienced golf trader who has been profiting weekly from trading this captivating sport on Betfair and for over 10 years, I’m thrilled to share my expertise and insights with fellow enthusiasts.

Golf trading on Betfair has gained immense popularity in recent years, and for good reason. It offers a unique and exhilarating opportunity to engage with the sport while potentially reaping substantial profits.

I vividly recall the excitement of my first successful golf trade, where I carefully analyzed player performance, tracked tournament progress, and timed my trades to perfection. Witnessing my green screen grow as the tournament unfolded was an incredible feeling, and it sparked my passion for golf trading.

However, I must admit that I’ve also experienced my fair share of setbacks and learning moments along the way. (as we all do)

Like any form of trading, golf trading on Betfair comes with its own set of risks and challenges. I’ve encountered moments where a golfer’s unexpected performance caused me to incur losses, reminding me of the importance of discipline and emotional control. Yet, it is through these experiences that I have honed my skills, refined my strategies, and developed a deep understanding of the intricacies of golf trading.

In this Golf Trading Guide, my goal is to provide you with strategies and tips that can help you navigate the world of golf trading on Betfair more effectively.

Whether you’re a seasoned trader looking to enhance your skills or a beginner seeking to dive into this exhilarating endeavor, you’ll find valuable insights and practical advice to boost your chances of success.

Together, we’ll discover how to navigate the ever-changing odds, capitalize on market fluctuations, and ultimately increase our chances of achieving profitable trades.

Let’s dive in and embark on this exciting journey of golf trading success.

Article Contents

Understanding Golf Trading on Betfair

If you are unfamiliar with this website and the “trading” concept then it is probably best to start with this, it’s 100% crucial to have a solid understanding of golf trading and how it differs from traditional betting.

Let’s delve into the concept and explore the advantages of using Betfair as our preferred platform.

The Concept of Golf Trading and its Distinction from Traditional Betting

Golf trading is a dynamic and interactive form of wagering that allows traders to buy and sell positions on golfers throughout a tournament.

Unlike traditional betting, where you place a single bet and wait for the outcome, golf trading provides the flexibility to adjust your positions based on changing circumstances.

It’s like riding the waves of a tournament, capitalizing on favorable odds shifts and adjusting your trades accordingly.

For example, let’s say you back a golfer before the tournament starts, believing they have a strong chance of performing well.

As the tournament progresses and the golfer’s odds decrease due to their impressive play, you can choose to lay (bet against) that golfer to lock in a profit or reduce potential losses.

Conversely, if a golfer you laid performs unexpectedly well, you might choose to back them to minimize your potential liabilities.

This interactive approach sets golf trading apart from traditional betting, providing more control, flexibility, and opportunities for profit throughout the tournament.

It is also a HUGE advantage in a sport like Golf where the big priced winners won’t come in every week.

But by trading we can often guarantee a profit just by picking players that “perform well” and this allows for more consistent profits.

Advantages of Using Betfair for Golf Trading

Let me explain more about this advantage and also why we prefer to use Betfair. Other exchanges are available but this is the BEST option for golf trading:

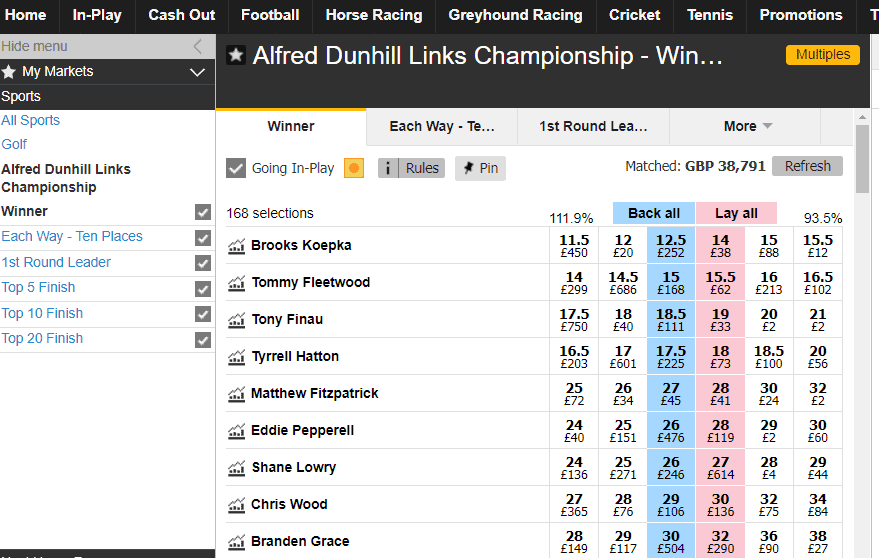

- Liquidity and Market Depth: Betfair boasts a large user base, ensuring liquidity and market depth for golf trading. This means there are ample opportunities to match your trades with other traders’ positions, allowing for efficient and seamless execution of your trades.

- Back and Lay Options: Betfair’s platform allows you to both back and lay positions on golfers. This flexibility enables you to adapt to changing circumstances and optimize your trading strategy based on your analysis and insights.

- In-Play Trading: Betfair offers real-time trading opportunities during golf tournaments. You can actively trade while the action unfolds, capitalizing on fluctuations in player performance, tournament situations, and odds movements. In-play trading adds excitement and potential profit possibilities to your golf trading endeavors.

- Wide Range of Markets: Betfair provides an extensive range of markets for golf trading, including outright winner, top-five and top-ten finish, head-to-head matchups, and more. This variety allows you to diversify your trading portfolio and explore different trading strategies to suit your preferences and expertise.

Key Terminologies in Golf Trading on Betfair

To navigate the world of golf trading effectively, it’s crucial to understand the key terminologies specific to this domain. Here are some essential terms you’ll encounter:

- Back: Placing a bet on a golfer to win or perform well in a tournament.

- Lay: Betting against a golfer to win or perform well in a tournament. This is essentially taking the opposing position to backing.

- Odds: The numerical representation of a golfer’s likelihood of winning or performing well. Higher odds imply a lower probability, while lower odds indicate a higher probability.

- Market: The specific golf trading market on Betfair, such as the outright winner market or top-five finish market.

- Stake: The amount of money you’re willing to risk or invest in a particular trade.

- Liability: In lay betting, liability refers to the potential amount you may need to pay out if the golfer you laid performs well.

By familiarizing yourself with these terminologies, you’ll be better equipped to understand discussions, analyze markets, and execute trades confidently on Betfair.

Golf Trading Philosophy

Before we really dive into the nitty gritty, if you are a trader of other sports you might already be wondering what the main “aim” of golf trading is and what could possibly make it attractive to trade for people with no interest in the sport.

Well, the main philosophy behind Golf Trading is the fact that the players prices are HUGE.

So, generally you are looking at “back to lay” trades but this is not like horse racing where you might be doing a back to lay on an 8-1 shot, here you are doing it on 80-1 shots or higher.

It is not unheard of to have winners in the triple digits due to the competitive nature of this sport.

Just check this chart.

This player was backed at 85-1 and traded as low as 1.22 when this screenshot was taken.

You can even see that he was back up to 2 when this screenshot was taken.

This is not a “freak” result, this is the NORM in Golf Trading, you just need to find them!

Check this one here trading from 180 into 6.6, these are the trades you are looking for in golf.

So if you were wondering if you should be EXCITED about Golf Trading then YES you should be and with good reason.

Preparing for Golf Trading

As I grew as a successful golf trader on Betfair, I understood the crucial role that thorough preparation plays in achieving consistent profits.

In this section, we will explore the essential steps to prepare for trading a golf tournament.

Researching Golf Tournaments

- The Importance of Researching Golf Tournaments Before Trading

Before placing any trades, it’s vital to conduct comprehensive research on the upcoming golf tournaments.

Research provides valuable insights that inform your trading decisions, helping you identify potential opportunities and mitigate risks.

By gaining a deep understanding of the tournament dynamics, you’ll be better equipped to anticipate outcomes and make informed trading choices.

- Factors to Consider, such as Course Conditions, Player Form, and Weather

When researching golf tournaments, consider the following factors:

a. Course Conditions: Assess the characteristics of the golf course, including its length, layout, rough conditions, and potential hazards. Different golfers excel under specific course conditions, so understanding how a course favors certain playing styles can give you an edge in your trading decisions.

b. Player Form: Evaluate the recent performance of golfers participating in the tournament. Consider factors such as their finishes in recent events, consistency, and overall form.

Analyzing player form allows you to identify golfers who are likely to perform well and potentially find trading opportunities.

c. Weather Conditions: Weather can significantly impact golf tournaments. Take into account the forecasted conditions, including wind speed and direction, rainfall, and temperature. Some golfers excel in adverse weather conditions, while others may struggle.

Anticipating the impact of weather on players’ performances can help you make strategic trading moves. The higher the wind the more unpredictable it can be which can actually be GOOD for trading.

By thoroughly researching these factors and staying up to date with the latest news and developments, you’ll have a solid foundation to make informed trading decisions.

How Important Is Watching Golf Live When Trading?

If you are unfamiliar with the sport of Golf you might be forgiven for thinking that you would need to watch the action as it develops to trade it profitably.

Only problem with that is that a golf tournament is not a 90 minute football match but often a FOUR day event and it is literally impossible to watch all that and trade it.

And I don’t know any trader that does.

Including myself and I actually cover this topic in more detail in this article here.

It is also impossible to “snipe” unless maybe you are at the tournament. The clips you will see on the TV are often bits of action that happened several minutes ago so there is no edge to be gained by seeing a player scoring a “hole in one” and then backing them.

Therefore, your typical golf trading strategies will involve taking a position and then adjusting it depending on how the tournament is developing.

My own golf trading strategy only requires me to “check in” once or twice per day to see if any action is required.

Literally, my only working time on these markets probably totals one hour per week (altogether!)

You can follow the action on the TV for a bit of fun if you like the sport but it is definitely not essential to have to watch golf or be an expert to trade it profitably.

How To Analyse Player Performance

- The Significance of Analysing Player Performance Data

Analyzing player performance data is a cornerstone of successful golf trading. It allows you to identify patterns, trends, and potential opportunities. By delving into the statistics, you can gain insights into a golfer’s strengths, weaknesses, and overall capabilities. Utilize this information to make data-driven decisions and align your trades with players who are likely to perform well.

- Tips on Accessing and Interpreting Player Statistics

To access player statistics, utilize reputable sources, including official golf websites, sports analytics platforms, and specialized golf data providers. Look for key metrics such as driving accuracy, greens in regulation, putting average, and scoring average. These statistics can reveal a golfer’s skills and consistency.

Interpret the data in the context of the tournament and its specific challenges. Compare a golfer’s current performance to their historical data to identify any noteworthy trends. Additionally, consider their performance on similar course types or under specific weather conditions. This comprehensive analysis will provide valuable insights for your trading decisions.

Keep in mind when trading Golf we aren’t looking for the winner, just a player who will “perform well”.

Effective Golf Trading Strategies

As a seasoned golf trader who has navigated the highs and lows of the sport on Betfair, I understand the importance of implementing effective trading strategies.

It took me YEARS to perfect my own strategy and it is important to find one you are comfortable with.

In this section, we’ll explore three key strategies: backing and laying players, trading in-play, and utilizing statistical analysis.

These strategies will help you make informed decisions, capitalize on market opportunities, and optimize your golf trading experience.

A. Backing and Laying Players

- The Concept of Backing and Laying Players

Backing a player in golf trading means placing a bet on their success or favorable performance. It involves buying their position, anticipating that their odds will decrease, and ultimately profiting from their success. Conversely, laying a player involves betting against their success.

By taking the opposing position, you can profit if the player performs poorly or fails to meet expectations.

NOTE: Keep in mind the prices in Golf tend to be quite high and you will have quite a big initial liability if going for the laying approach.

- Strategies for Identifying Opportunities to Back or Lay Specific Players

a. Back To Lay Classic: Utilize your research on player performance, course conditions, and tournament dynamics to identify golfers who are likely to excel. Look for players with a strong track record on similar courses or in specific weather conditions.

Back these golfers early in the tournament when their odds are relatively higher, but you have confidence in their potential performance.

b. Reactive Laying: Monitor the tournament closely and be prepared to lay a golfer who is initially performing exceptionally well but shows signs of declining performance.

Look for opportunities to lay such players at shorter odds, locking in a profit or limiting your potential losses if their form deteriorates.

c. In-Play Momentum Trading: In-play trading allows you to react to live tournament developments.

Identify players who are gaining momentum or experiencing a surge in performance during the tournament. For example, on day 1 you might see a big outsider get to the top of the leaderboard. His (or her) price might still be huge and around 40-50/1 but if they can maintain this position then they could come into around 20 and you can trade out.

These are short sharp trades and you have to keep a close eye on the event itself to spot these.

Back them at longer odds and sell your position when their odds decrease. Similarly, be alert to players who start strongly but show signs of struggling. Laying such players in-play can be a strategic move to secure profits or reduce liabilities.

By combining research, market awareness, and timely decision-making, you can effectively back and lay players to maximize your profits in golf trading.

Strategies for Identifying Favorable In-Play Trading Opportunities

1. Monitoring Player Performance: Keep a close eye on the live tournament action, including player shots, scores, and overall momentum. Look for players who are gaining confidence, exhibiting consistent performance, or demonstrating an ability to make a comeback. Back or lay these players based on your assessment of their current form and the odds available.

2. Weather and Course Impact: Consider how weather conditions or changes in course conditions can affect player performance. Sudden weather shifts or challenging course sections can influence players’ scores and confidence levels. Use this knowledge to identify potential trading opportunities as odds may shift based on these external factors.

3 Reacting to Momentum Shifts: Pay attention to momentum swings during a tournament. If a player starts poorly but shows signs of improvement or a sudden surge in performance, consider backing them to ride the momentum wave. Conversely, if a player falters after a strong start, consider laying them to capitalize on their potential decline.

By being attentive, flexible, and responsive to the live action, you can identify favorable in-play trading opportunities and make timely trades to enhance your profitability.

Also, with the high prices on offer to lay at, you will have to be careful to ensure you do not get over exposed.

You could also look to the derivative markets such as top 10 finish to lay a player who has started well but you think will falter.

In Golf, it doesn’t take much for a player to completely choke and fall out of the leading positions.

Utilizing Statistical Analysis

Statistical analysis plays a significant role in golf trading by providing objective insights into players’ performance trends and potential outcomes.

Utilizing statistical indicators can guide your trading decisions and offer a data-driven perspective on players’ strengths and weaknesses.

Popular Statistical Indicators and How to Interpret Them

a. Strokes Gained: Strokes gained is a metric that measures a golfer’s performance compared to the field average. Positive strokes gained indicate an above-average performance, while negative strokes gained indicate a below-average performance. Analyzing strokes gained allows you to identify players who excel in specific aspects of the game, such as driving, putting, or approach shots.

b. Greens in Regulation (GIR): GIR measures the percentage of holes in which a player reaches the green in the regulation number of strokes. A higher GIR percentage suggests strong ball-striking skills and the ability to avoid potential hazards. Assessing a player’s GIR can indicate their consistency and potential for scoring well.

c. Scrambling: Scrambling refers to a golfer’s ability to recover and make par or better after missing the green in regulation. Analyzing scrambling statistics helps assess a player’s short game proficiency and their capability to save strokes when faced with difficult situations.

Interpreting these statistical indicators in the context of the tournament and players’ historical performance provides valuable insights for your trading decisions.

Consider how these statistics align with the course characteristics, playing conditions, and players’ previous performances to make informed trades.

By leveraging statistical analysis, you can enhance your trading decisions, identify opportunities, and gain a competitive edge in the golf trading market.

Managing Emotions and Discipline

As a professional golf trader who has experienced the highs and lows of the market, I now understand that mastering the psychological and strategic aspects of golf trading is essential for long-term success.

- The Psychological Aspects of Golf Trading

Golf trading can evoke powerful emotions, such as excitement, anxiety, and frustration. Managing these emotions is crucial for making rational decisions and maintaining discipline. Embrace the fact that losses are part of the trading journey, and maintain a long-term perspective to navigate through ups and downs.

With my own golf trading strategy I know I can be in the green on most weeks but if you are trying to just catch the winner then you might only be in the green a few times per year.

This is why Golf Betting is not for your average punter as most will get frustrated at all the losses and I was one of them.

Thankfully, Golf Trading is a lot more forgiving.

Here are some mindset tips that have helped me:

a. Stick to Your Trading Plan: Develop a solid trading plan and adhere to it. Define your entry and exit criteria, risk management strategies, and goals. Following a well-defined plan helps reduce impulsive decisions driven by emotions.

b. Control Risk Exposure: Set risk limits for each trade to avoid overexposure and potential significant losses. Determine the maximum percentage of your bankroll you’re willing to risk on a single trade, and stick to it.

c. Take Breaks and Recharge: Trading can be intense and mentally demanding. Take regular breaks to rest, recharge, and clear your mind. This allows for better decision-making and helps prevent emotional trading driven by fatigue or frustration.

Following my own golf trading strategy, the workload is not too intense. I can check the trades at set times of the day and then carry on with my weekend.

Sometimes, if it is an American tournament then I often check my final profits over breakfast on Monday morning!

By prioritising emotional control and discipline, you can maintain a focused and objective approach to golf trading, increasing your chances of success.

Learning from Mistakes and Adaptability

- The Importance of Learning from Trading Mistakes

Mistakes are valuable learning opportunities in golf trading. Embrace them as lessons rather than failures. Analyze your trades, identify areas for improvement, and learn from your experiences. This ongoing learning process is crucial for refining your strategies and enhancing your trading skills.

- Encouraging Adaptation of Strategies Based on Experiences

Flexibility and adaptability are key to thriving in the ever-changing world of golf trading. Be open to adjusting your strategies based on market conditions, tournament dynamics, and your own trading experiences. The ability to adapt allows you to stay ahead of the curve and optimize your trading performance.

My own golf trading strategy adapted over time as I began to realise that I needed regular winning trades and didn’t have the patience to wait for that 100-1 shot to put me into profits.

I also didn’t want to be stuck by the screen all day following the action.

Your own strategy can vary depending on what you are willing to do.

A Golf fanatic might love to be involved all day long from Thursday to Sunday whilst a regular sports trader would want to minimise his efforts whilst remaining profitable.

By learning from mistakes, embracing adaptability, and continuously improving your skills, you’ll evolve into a more proficient and successful golf trader.

Conclusion

So I really hope this guide has helped you with your initial dabble into the world of Golf Trading

Apply the knowledge gained and implement these strategies to elevate your golf trading skills. Remember, success in golf trading requires practice, discipline, and continuous learning.

For further learning and development, submit your email to the form below and we will be in touch regarding taking your golf trading to the next level.

Wishing you all the best in your golf trading endeavors.

May your trades be profitable and your journey be filled with excitement and success!

-----------------------------------------------------------------------

Want to see HOW we make Correct Score Trading Profits Like This?

Check out our FREE Correct Score Trading ebook while it is still availableand get it all explained.

Price: FREE

Just tell us where to email it to...

CLICK HERE TO DOWNLOAD NOW!-----------------------------------------------------------------------